The tax filing season is upon us, and many will be looking for someone to help them file a tax return. The IRS announced that the 2019 tax filing season will begin on Jan. 27. The agency expects to receive more than 150 million individual income tax returns.

If you are searching, choose their tax return preparer wisely. This is because it is ultimately you, the taxpayer, who is responsible for all the information on your income tax return. It is important to remember this is true no matter who prepares the return.

Here are some tips to remember when selecting a preparer:

- Check the Tax Preparer’s Qualifications.

You can use the IRS Directory of Federal Tax Return Preparers. This tool helps you confirm (or find) a tax return preparer with specific qualifications. The directory is a searchable and sortable listing of preparers. - Check the Preparer’s History.

If you have the confidence, you can ask the local Better Business Bureau. They should check for disciplinary actions and the license status for credentialed preparers. There are some additional organizations about specific types of preparers:

Enrolled Agents – Licensed by the IRS. Enrolled agents are subject to a suitability check and must pass a three-part Special Enrollment Examination, which is a comprehensive exam that requires them to demonstrate proficiency in federal tax planning, individual and business tax return preparation, and representation. They must complete 72 hours of continuing education every 3 years.

Certified Public Accountants – Licensed by state boards of accountancy, the District of Columbia, and U.S. territories. Certified public accountants have passed the Uniform CPA Examination. They have completed a study in accounting at a college or university and also met experience and good character requirements established by their respective boards of accountancy. In addition, CPAs must comply with ethical requirements and complete specified levels of continuing education in order to maintain an active CPA license. CPAs may offer a range of services; some CPAs specialize in tax preparation and planning.

Attorneys – Licensed by state courts, the District of Columbia or their designees, such as the state bar. Generally, they have earned a degree in law and passed a bar exam. Attorneys generally have on-going continuing education and professional character standards. Attorneys may offer a range of services; some attorneys specialize in tax preparation and planning.

- Ask about Service Fees.

Avoid tax preparers who base fees on a percentage of the refund or who boast bigger refunds than their competition. Be wary of tax return preparers who claim they can obtain larger refunds than others can. - Ask to e-file.

The quickest way for you to get a refund is to electronically file your federal tax return and choose direct deposit. - Make Sure the Preparer is Available.

You will likely want to contact your tax preparer after this year’s April 15 due date. Tax planning, changing the return and updates. Avoid “fly-by-night” preparers. Consider whether the individual or firm will be around for months or years after filing the return to answer questions about the preparation of the tax return. - Provide Records and Receipts.

A good tax preparer will ask to see records and receipts. They will ask questions to calculate things such as the total income, tax deductions and credits. - Never Sign a Blank Return. (NEVER)

Do NOT use a tax preparer who asks you to sign a blank tax form. - Review Before Signing.

Before signing a tax return, be sure to review it. Do ask questions if something is not clear. You should feel comfortable with the accuracy of your return before you sign it. Once you sign the return, you are accepting responsibility for the information on it. - Review details about any refund.

Make sure your refund goes directly to you! Not to the tax preparer’s bank account. You should review the routing and bank account number on the completed return. - Ensure the Tax Preparer Signs and Includes their PTIN.

All paid tax preparers must have a Preparer Tax Identification Number. By law, paid preparers must sign returns and include their PTIN. - Report Abusive Tax Preparers to the IRS.

Most tax return preparers are honest and provide great service. However, some preparers are dishonest. Report abusive tax preparers and suspected tax fraud to the IRS. Use Form 14157, Complaint: Tax Return Preparer.

Your first decision about who will prepare your taxes might be whether it is you or a tax professional.

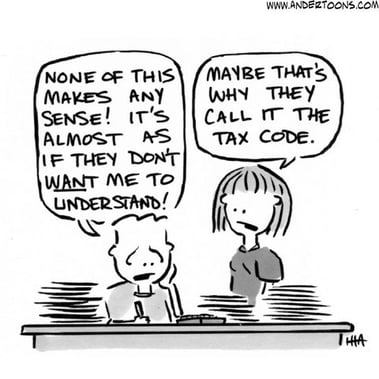

This is a decision you make every year but if you are self-employed and believe you have the skills and tools to do your own taxes, keep in mind there are good arguments for hiring a professional rather than doing it on your own. You may have a more complex financial situation than you realize. Answering questions in software seems simple enough but one wrong answer can cost tens of thousands of dollars.

This is a decision you make every year but if you are self-employed and believe you have the skills and tools to do your own taxes, keep in mind there are good arguments for hiring a professional rather than doing it on your own. You may have a more complex financial situation than you realize. Answering questions in software seems simple enough but one wrong answer can cost tens of thousands of dollars.

You may not be up to speed with the latest tax regulations and opportunities. For instance, Congress renewed a package of tax credits and deductions at the end of 2019 and now they’re up for grabs.

There are also reasons to start early. One reason: Scammers who make off with your Social Security number or EIN may rush to file fraudulent returns to snag your tax refund. While the IRS Criminal Investigation Unit managed to identify $9.69 billion in tax fraud in 2018, and it initiated 1,714 investigations. The risk is real.

Please contact us if you need help. We can help you with tax planning and tax preparation. (and enjoy relieving you of the stress)