Business owners and managers have probably never faced such a period of change as we are currently seeing. Change carries great risk, but where there is risk there is opportunity.

There are three principle areas that your management must focus on to survive and prosper in this period of change:

1) YOUR VALUABLE FORMULA - (read article here for detailed overview )

Re-assess the competitive element that generates profit and sustainable success for the business.

2) MODIFY OPERATIONS – (read article here for detailed overview)

Change the way business works to adapt quickly to the changed environment.

3) CASH MANAGEMENT - (review below)

Establish the absolute priority of cash over profit and investment while the storm is blowing.

These are the inter-related and ignoring any of them will be detrimental to the long-term success of the business.

MANAGE FOR CASH

At the sharp end of things is the need to manage for cash. If you can’t pay your bills, no matter how profitable you are, you will crash and burn. There are many tactics that can improve cash flow. Some of these are short term and one-off measures. However, to resolve any cash crisis you must have the right Valuable Formula and you must operate the business sensibly.

GETTING YOUR BALANCES SHEET RIGHT

Many businesses have a poorly structured balance sheet and pay the price for it.

DEFINITION - GEARING

Interest Cover = Profit/Interest Expense

Gearing is debt/equity and a balance sheet that is highly geared or highly leveraged has used a lot more debt that equity to purchase assets.

Assets – Liabilities = Equity ---- or restated ---- Equity + Liabilities = Assets

This means the funding of assets has come from either debt or equity and the proportion of each used is called gearing or leverage.

1) Gearing is more important than ever.

Assets are financed from either debt or equity and the right balance is needed.

-

- As things get tight, try and move your balance sheet to a lower gearing. (more equity and less debt) as this reduces risk and also reduces the servicing costs.

- Equity is more expensive as it carries a risk and hence demands a higher return over the long term, but it is more forgiving in terms of servicing in the short term.

- For many privately owned businesses there is funding from shareholders (founders) that appears as debt but is quasi equity in that it is very long term; it is not expected to be paid back and it carries no interest. For the purposes of calculating your gearing, this should be treated as equity.

- It is important to remember that equity comprises capital contributed to the business plus any retained earnings left in the business, so if you are a profitable business and you have not taken all the profits out, you are building equity. If you draw more cash out than you have made in profits, then you have reduced your equity. In tough economic times where losses are being made, your equity in the business will be reducing and as a consequence your gearing is increasing, and this can lead to trouble.

2) A debt free balance sheet is sometimes described as lazy.

The return to shareholders (Return on Equity) can be increased with the judicious use of debt. It is a question of getting the right balance.

-

- The example below shows how ROE can be increased from 25% to 40% with the proper use of debt.

- A good calculation to look at is your interest cover which is the number of times your profit covers your interest expense. Higher levels of debt can be tolerated when the business is profitable and has high interest coverage. Certainty of earnings becomes very important and this takes us back to your Valuable Formula and how robust this is.

3) Asset funding.

A big use of debt is asset funding and doing this the wrong way can lead to problems.

-

- Assets should be funded within the lifespan of the asset, in particular those with the short life spans. There is nothing worse than still paying off a loan relating to an asset that has worn out. It is important to match the asset life to the funding cycle.

- Conversely, paying off assets quickly may draw too much from cash flow and restrict other business development activities. Many businesses pay for assets, such as computers, out of cash flow and over time that can be a lot of working capital.

- Trade debt is good for funding working capital but should not be used for capital expenditure.

SALES LEAD TO CASH CYCLE

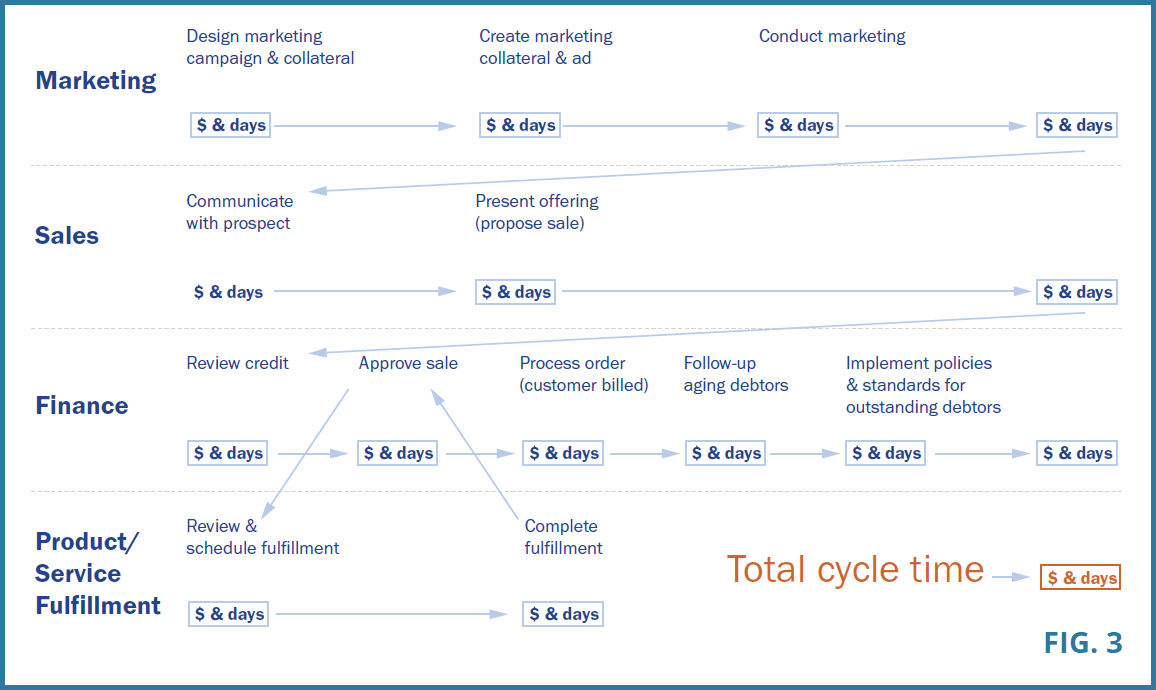

Sales lead to cash cycle is defined as the time it takes from marketing a product to banking the cash from the sale of that product. Put simply, it’s the number of days from initial investment (marketing) to payment in full. This is often quite a long time.

There are many steps in this process and responsibility passes through several sets of hands. It is quite natural that there is slippage, down time, duplication and things missed. All of these things create opportunities to make efficiency improvements.

1) What is your current investment?

The following diagram (FIG. 3) is a simple calculator of just how much investment you have in this cycle. It can be completed by estimating the number of days each process takes, or you could estimate the costs incurred at each stage and see the actual monetary investment.

We think of our investment in working capital as receivables days and if this is running at 60 days most managers are beginning to panic. If you take a more comprehensive look, you will find that from when you start designing a marketing campaign until you collect the cash, 270 days might be more common.

If management thinks having 20% of cannula revenue tied up in receivables is bad, when you look at the actual money invested over 270 days, even the hardiest manager will get a shock. Just take this thought a little further. How many marketing activities successfully generate leads which are then allowed to cool before sales actually gets to them? How often is a sales order taken and the business fails to fulfill the order quickly? There is typically low hanging fruit for business improvement in the sales lead to cash cycle.

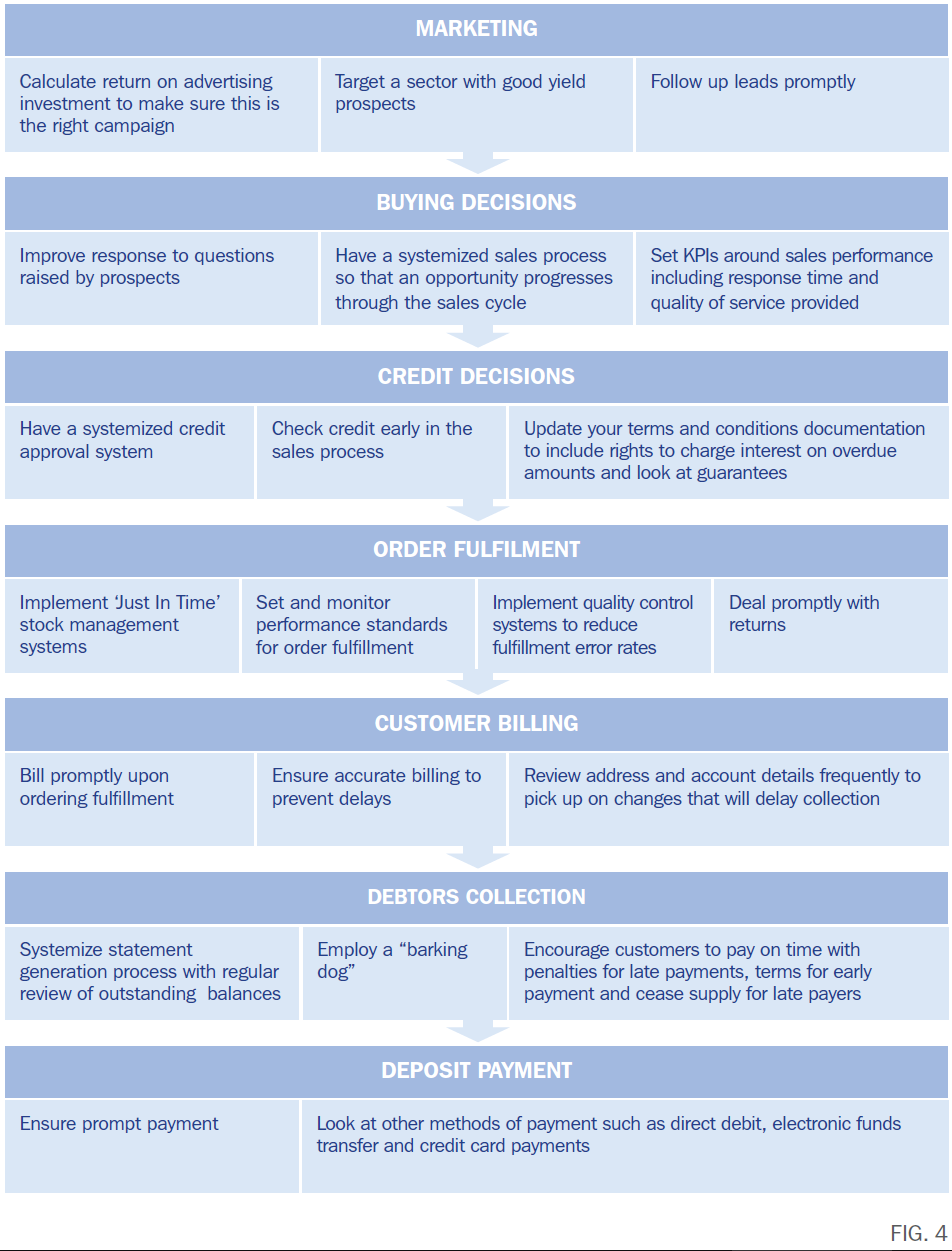

2) Improving the sales lead to cash cycle.

There are a number of phases you go through in this cycle and this section looks at the ways you can accelerate the progression through the cycle.

(FIG 4) shows the major phases in the sales lead to cash cycle and the sorts of activities you should be implementing.

SUPPLY CHAIN MANAGEMENT

The other side of the business relates to your purchases, inventory management and workflow. This is supply chain management and typically there are operational efficiencies to be had but usually not as many as on the credit side. Most managers are pretty good at counting pennies and this side of the business is watched carefully. However, there are improvements possible from the use of technology and management information that can help substantially.

1) Improving your relationship and terms of trade with suppliers.

We mentioned earlier that trade suppliers are an important source of finance. Even more importantly, they supply you with the goods and services you need to supply your customers. And you, along with many other businesses, sit in an industry supplier chain. The efficiency of that supplier chain impacts all your viability and competitiveness. It is said now with globalization that real competition exists not between individual businesses, but between competing supplier chains.

Take grocery shopping – as consumers, we tend to think the competition for our grocery purchases is between two or three supermarket chains. But when you think about it, what each supermarket has to offer is very much dependent on all the businesses in the supply chain each has built to support them at the final retail sale. This comprises of distribution, warehousing, processing, growing, cold storage, marketing, packaging, and so on. The ability of one supermarket to provide a superior offering to customers is very dependent on how efficiently their supply chain works.

This is not to say there is not competitive pressure within a supply chain. Of course there is, but the nature of the relationships is changing. Technology is allowing the creation of an integrated supply chain where demand can be converted to orders through the whole chain.

-

- Relationship building with suppliers is becoming as important to a business as relationship management with customers. Suppliers are considered strategic partners and the more you can help them with certainty over how much business you do with them, the more efficient and successful your supply chain becomes. This creation of value must be shared, and this is the opportunity for you to improve your terms and conditions.

-

- When talking to suppliers about how much business you have for them, make sure you discuss payment terms, prices, (including fixed prices for a time), volume rebates consignment stock and contribution towards your marketing for their products.

- For non-strategic suppliers, you may wish to review prices periodically and run a bid. This includes the providers of power, telecoms, stationery, freight, couriers, insurances, banking services and anything else you spend money on. There are usually better deals to be had by shopping around for these items.

2) Inventory management.

There are significant costs to holding inventory including financing costs, space requirements, stock obsolescence, damaged stock and pilferage. You can optimize your investment in inventory by:

-

- Breaking your inventory into product groups and reviewing turnover by groups.

- Establishing optimal reordering levels – these should be lowering because of the improved delivery times with “Just in Time” inventory systems.

- Return slow moving items.

3) Work flow improvements.

How well you go about your normal business can have an impact on business performance. Every business provides goods or services in some form and the delivery of these involves work flows (processes). Once again, advances in technologies, readily available work flow solutions (usually built specifically for an industry) and a workplace culture of customer centricity can all lead to improvement in efficiencies. Key things to look for are:

-

- Reduction of bottlenecks in work flow.

- Elimination of shortages of raw materials.

- Scheduling resources appropriately.

- Alignment of production capacity with sales orders.

- Measurement and management of productivity.

OTHER WAYS TO MANAGE YOUR CASH

This article does not pretend to be exhaustive with regard to how you can better manage your cash. Rather, we have focused on areas where improvement is most likely and perhaps areas not regularly considered. Additional areas include:

-

- Deferment of capital expenditures

- Implementation of spending policies and controls by setting authority levels and making it clear who can order items.

- Adoption of a culture of cash preservation and cost control, which must start with the boss leading by example.

- Budgeting and monitoring of cash forecasts regularly, particularly for the receipt of payments from receivables.

GET HELP

There is an old saying, “pride goes before the fall”. We are living in extraordinary times and crisis combined with the ongoing technological changes are creating an environment of uncertainty the like of which has not been seen before. You cannot assume your business is OK, you cannot assume that what has worked for you in the past will work for you now.

Stand back and get a second opinion about your business and how it is performing. Take a moment to reach out to one of our advisors. Sometimes it is beneficial just to share the burden and our proven solutions and experience can help you through to a recovery.