How to position your business for recovery the right way.

How do we navigate our way through the economic turmoil? How do we ensure that our businesses continue to perform well and provide us with the ability to enjoy a full and rich life outside the workplace? How do we ensure that our businesses will in fact prosper, or at least be positioned to prosper, in the future?

For many of us business owners, our current business represents the result of long term and well honed skills, combined with a primary desire to be our own boss and make our own way in this world. This often means that we may not have gone through the rigorous process of examining our business idea which is undertaken by large listed enterprises. This need not necessarily be an issue, after all the big boys can get it wrong too. But the bottom line is there is a good reason why big businesses spend significant amounts of time and money to ensure they have a robust business model, (which we call your business’ Valuable Formula), that guarantees ongoing financial reward.

I want to offer you a clear and concise way for a privately held business to re-examine itself, to identify the key elements of its success, to develop strategies for ensuring its survival during economic turmoil, and ultimately to build a plan for thriving in the present and in the future.

Positioning your business for recovery can become fairly complex, so we will segment it:

> Valuable Formula

> Modify Operations

> Products and Services

> Marketing and Sales

> Systems and Processes

> Human Resources

> Cash Management

> Getting Your Balance Sheet Right

> The Sales Lead to Cash Cycle

> Supply Chain Management

> Alternative Cash Management Options

Business owners and managers have probably never faced such a period of change as we are currently seeing. Change carries great risk, but where there is risk there is opportunity.

Of these, there are three principle areas that your management must focus on to survive and prosper in this period of change:

1) YOUR VALUABLE FORMULA

Re-assess the competitive element that generates profit and sustainable success for the business.

2) MODIFY OPERATIONS

Change the way business works to adapt quickly to the changed environment.

3) CASH MANAGEMENT

Establish the absolute priority of cash over profit and investment while the storm is blowing.

These are the inter-related and ignoring any of them will be detrimental to the long-term success of the business.

YOUR VALUABLE FORMULA

Why is a business successful? Let’s introduce the concept of the Valuable Formula, which helps explain why any given business is successful. The success of a business is dependent on its business model and good business models are based on a Valuable Formula.

A business model is defined as the combination of the following elements:

WHAT products or services you sell.

WHO buys them.

WHY they buy them.

HOW you make a profit out of the transaction.

Of these, there are two specific aspects of the business model that you really need to understand the identify your Valuable Formula.

First – Why do customers buy from you?

Your customers might come to you because…

- You have a convenient location

- There is easy parking

- Your after sales service is good

- You recognize and greet all your customers

- You have a unique understanding of their business

- Your product/service is the best value for the money

- No one else can supply your products or services

There is always at least one reason why a customer buys from you (although it is usually a combination of reasons and these vary across different market segments).

Second – HOW does your business make a profit?

In relation to HOW you make a profit, what is it you do that allows you to generate a margin over your costs? Do you have lower costs than your competitors, and if so, why? Is it because:

- You are skilled at producing your products more efficiently?

- Do you have a source of raw materials that others pay more for?

- You can command a premium price because your service is so exceptional that people are willing to pay a little more or you provide 24/7 service?

There are always reasons and understanding them is a vital piece of business intelligence. The WHY and HOW add up to your Valuable Formula.

This case study walks through an example and applies the Valuable Formula to a small business.

INSTANT ACCESS HERE:

CASE STUDY – FRIENDLY COMPUTER SYSTEMS

IDENTIFYING THE VALUABLE FORMULA

Professor Michael Porter has laid the foundation for much of our understanding in the area of competitive strategy. He argues that a business will win in the market if it is a price leader, is differentiated in some way or focuses on a particular segment. The challenge is to know which of these is at work for you, particularly if it is differentiation (because you will need to understand exactly what makes you different).

In a world where the financial crisis and technology are causing rapid changes, your Valuable Formula can change very quickly. Consider the following classic examples:

- The near fatal impact of digital cameras on Kodak

- The virtual demise of the beautifully bound and printed Encyclopedia Britannica as a result initially of the launch of the first online encyclopedia.

- Encarta, and in recent times, Wikipedia; or, the impact of direct customer access to online flight and accommodation bookings on the traditional travel agent.

What you really need to know about your Valuable Formula is precisely how valuable it is. For some companies the Valuable Formula is protected as intellectual property, in the form of patents, trademarks, copyright or through commercial security (think Coke and the formula for the beverage, Microsoft and its software code, pharmaceutical products and so on).

In other instances, the Valuable Formula cannot be legally protected. Irrespective of the source of your Valuable Formula, it must be protected, and it must develop and change the times.

And herein lies the problem. In good times many businesses take their Valuable Formula for granted – or even worse they don’t really understand why it is they are successful. However, when the external environment is changing, the dynamics of your Valuable Formula can change, and adverse outcomes can emerge. Businesses with a “weak” Valuable Formula are going to feel the pain quickly, but even those whose strong Valuable Formula is only gradually being eroded by change will, equally surely, come under pressure. Your edge in the market will slip and this will manifest itself in reduced margins, loss of market share and declining profitability.

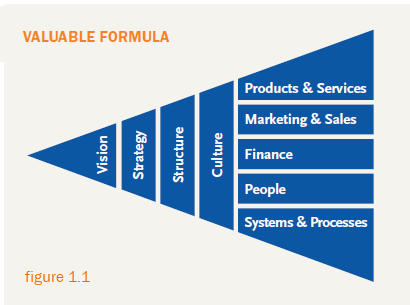

We use a particular strategic management framework for a business, represented in the rocket diagram below that illustrates the point.

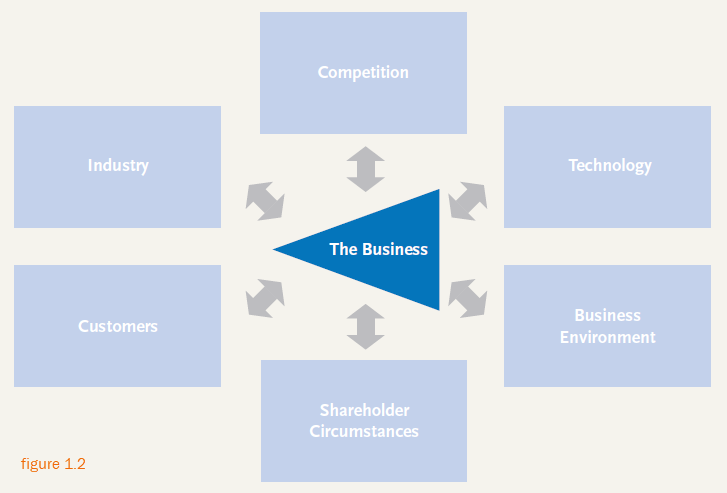

Of course, no business exists in isolation from the environment it operates in and the current crisis proves this point. The external environment, just like the internal elements of a business, can best be understood and managed when broken down into compartments. The next diagram shows the business in the context of the external environment.

CURRENTLY

There are two major threats in the current environment. The first and most pressing is the looming global economic crisis which is having an immediate and material impact on business confidence. The financial crisis will impact profitability with downward pressure on prices, and potentially reduce revenues, but with the businesses retaining the same cost structure.

The second major driver of change is in technology and the continued evolution of the digital economy. This continues to challenge paradigms, the rules of businesses are challenged and, in some areas, rewritten. The impact on the Valuable Formula cannot be underestimated. We are seeing the emergence of the new dominant businesses, and the decline of many others which are still embracing their Valuable Formula based on the traditional economy.

The key point is this. You must re-examine your Valuable Formula and make sure what you are doing is relevant to the current marketplace, because if you are not doing the right things strategically, the right things will not happen in the rest of your business. Working harder and longer is not going to fix a broken Valuable Formula.

To review the robustness of your business, work through the changes in the different elements of the external environment (see figure 1.2) and ask what impact each of these might have on the various components of the business framework we looked at in figure 1.1.

REVIEW

BUSINESS MODEL – defines what business you are in – it is WHAT products and services you sell, WHO buys them and WHY, and HOW you make your money from this.

VALUABLE FORMULA – is the reason your business is profitable and successful – it is a deeper understanding of WHY customers buy and HOW you make your profit.

ROCKET STRATEGIC MANAGEMENT FRAMWORK – is a model we use to diagnose a business by its internal components and to analyze the various elements of the external environment. (See figures 1.1 and 1.2)

FUTURE PROOFING - is reviewing your Valuable Formula in terms of the major changes occurring in the external environment which comprises Customers, Competitors, Industry, Technology, Shareholder Circumstances and Business Environment.

QUESTIONS?

Are you prepared to manage your business for recovery? Do you understand your Valuable Formula? If you have questions and need help, please contact us directly by email or phone. our team would be happy to help.