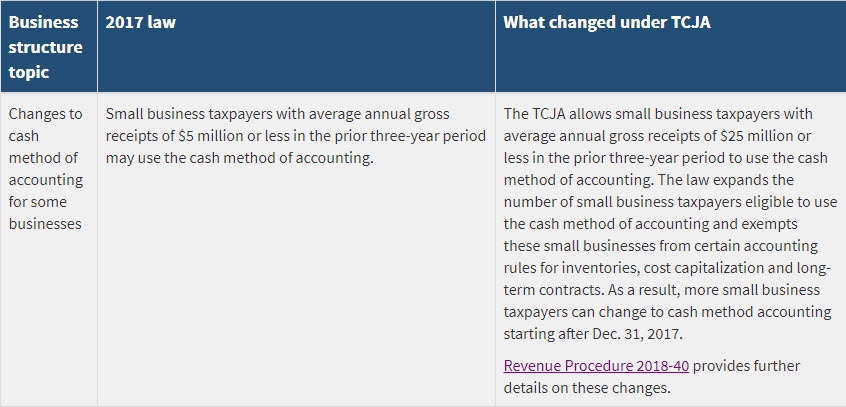

The Tax Cuts and Jobs Act – better known simply as tax reform – allows more small business taxpayers to use the cash method of accounting. Tax reform now defines a small business taxpayer as a taxpayer that has average annual gross receipts of $25 million or less for the three prior tax years and is not a tax shelter.

Here’s how last year’s legislation changed the rules for small business taxpayers:

- Expands the number of small business taxpayers eligible to use the cash method of accounting by increasing the average annual gross receipts threshold from $5 million to $25 million, indexed for inflation.

- Allows small business taxpayers with average annual gross receipts of $25 million or less for the three prior tax years to use the cash method of accounting.

- Exempts small business taxpayers from certain accounting rules for inventories, cost capitalization and long-term contracts.

- Allows more small business taxpayers to use the cash method of accounting for tax years beginning after Dec. 31, 2017.

Other examples of changes as a result of the

Tax Cuts and Jobs Act:

Business structure and accounting methods

The TCJA has expanded the number of small business taxpayers eligible to use a cash method of accounting by raising the cap on gross receipts from $5 million (C corporations) or $10 million (partnerships, S corporations, and other flow through entities) to $25 million averaged over the prior three years.

An organization’s business structure is an important consideration when applying tax reform changes. The Tax Cuts and Jobs Act changed some things related to these topics.

Businesses with employees: Changes to fringe benefits and new credit

For businesses that have employees, there are changes to fringe benefits and a new tax credit that can affect a business’s bottom line.

Revenue Procedure 2018-40 provides the procedures that a small business taxpayer may use to obtain automatic consent to change its methods of accounting to reflect these statutory changes.

For a more complete before-and-after comparison for small businesses:

Tax Cuts and Jobs Act: A comparison for businesses

The tax reform bill provides tax savings for small and medium business owners — but business owners need to make sure that they take a serious look if they are to maximize their potential savings under the tax laws. Need help with understanding and making decisions around the new tax reform? Please let me know how we can help!